The Q1 2020 smartphone shipment reports are out now, and three tracking firms have reported double-digit drops in global shipments in the wake of the COVID-19 pandemic.

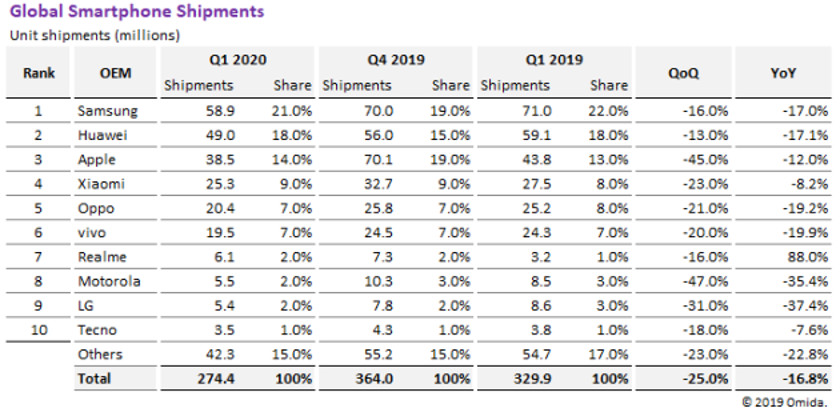

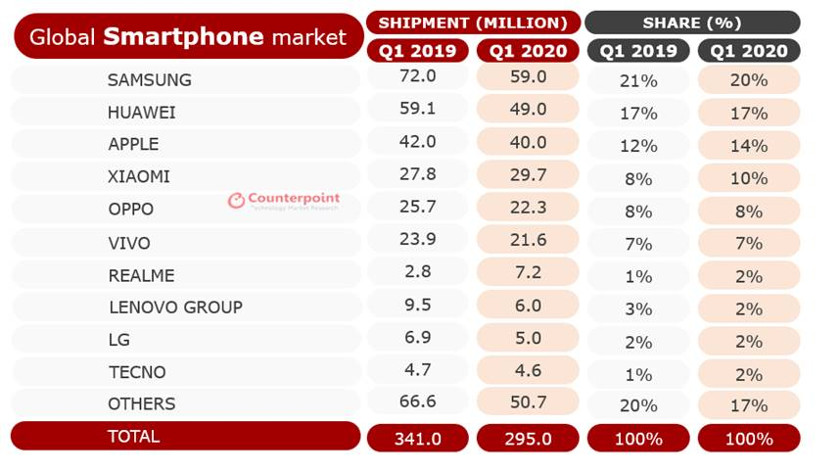

Canalys and Counterpoint Research reported year-on-year drops of 13% for the quarter, while Omdia said smartphone shipments dropped by 16%. Either way, this represents an unprecedented drop for the industry. Click the images below to view the tracking figures.

The three tracking firms all reported lower figures for the top three players (Samsung, Huawei, and Apple respectively), with Samsung and Huawei seeing a year-on-year drop of between 17% and 18%, while Apple was listed as dropping by between 5% to 12%.

Xiaomi and Realme stand out

But two out of the three tracking firms reported that fourth-placed Xiaomi was the only brand in the top five to actually grow its smartphone shipments (by between 7% and 9%). The third tracking company reported an 8.2% year-on-year decline for the Chinese firm.

Omdia and Counterpoint Research also note that Realme saw explosive growth during the quarter, claiming growth of between 88% and a massive 157%. Omdia didn’t list Realme in its report.

To be fair, Realme is a relatively new brand, and growth tends to look impressive when you’re starting from zero. But the company’s recent Realme 6 series offer plenty of bang for the buck, while the Realme X50 Pro 5G is one of the cheapest 5G flagships in Europe right now. So it isn’t really a surprise to see its smartphone shipments grow in general — its performance in the current economic climate is impressive though.

Two out of the three tracking firms say OEMs are bracing for an even steeper decline in Q2 2020, although all eyes are on the second half of 2020 for a potential recovery.

“The smartphone market will face major struggles in the first half of 2020 as different countries experience the initial shock and recovery periods at different times. That’s why OEMs are more afraid of second-quarter sales results,” Jusy Hong, research director at Omdia, was quoted as saying. “However, Omdia does expect the smartphone market to start to recover in some countries and regions in the second half of the year.”

“Most smartphone companies expect Q2 to represent the peak of the coronavirus’ impact,” said Canalys senior analyst Ben Stanton, adding that brands need to adapt their strategies during this time.

More posts about smartphones

from Android Authority https://ift.tt/3aX4YGe

via IFTTT

Post a Comment