This is The TechCrunch Exchange, a newsletter that goes out on Saturdays, based on the column of the same name. You can sign up for the email here.

DoorDash filed to go public on Friday, meaning we’ll have at least one more unicorn IPO before 2020 comes to a close. For a high-level look at its numbers, I wrote this, Danny covered who will profit from the deal, and I noodled on the impact of COVID-19 on its business.

I bring all that up because there is another COVID-19 impacted unicorn that we are expecting to see go public in very short order: Airbnb.

When Airbnb filed to go public in August, it seemed like a solid plan. The company was widely reported to be on an upswing from its COVID-doldrums, the public markets were hot for growth and tech shares, and the pandemic’s caseload in the United States was coming down from its summer highs. It looked great for Airbnb to wrap its Q3, drop its public S-1 with the new numbers, and laugh all the way to the bank after showing investors that even a global pandemic and travel industry depression couldn’t stop it.

And yet. The United States and world at large are now in the midst of the worst COVID-19 spike yet, and consumer spend is going down right before we get the company’s S-1. November feels less winsome for an Airbnb recovery than August or September did. Still, when Airbnb files — next week, the scuttlebutt indicates, so get ready — we’ll only have a look at its numbers through the third quarter.

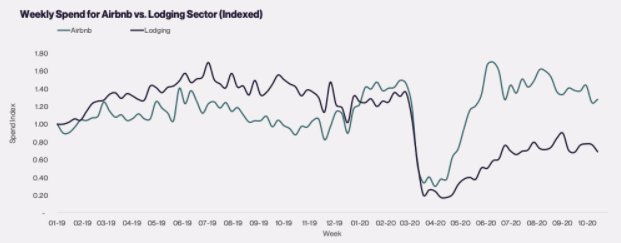

That’s effectively the same timeframe for a dataset that the folks at Cardify sent over and I dug through. Per the company, which tracks real-time consumer spend data, here’s a look at how well Airbnb recovered ahead of its larger industry after the initial recession in pandemic lodging spend:

Impressive, right? Sadly for Airbnb, the initial boom of demand through late June into July tapered as time continued.

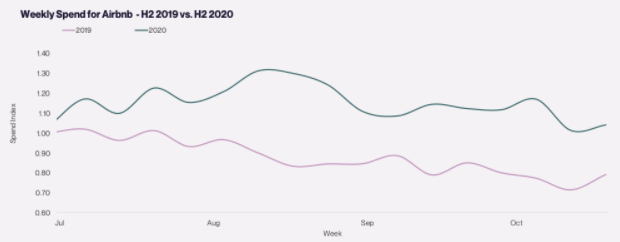

Zooming in somewhat, here’s Airbnb spend data from July 2020 through the end of October, the first month of Q4, compared to the same period of 2019:

Declines, then, but still an encouraging set of data for the company regardless. I would not have expected Airbnb spend — via third-party, admittedly — to be this strong.

The trend of folks renting a house for a month seems to have diminished somewhat, in case you are factoring that into your mental math concerning Airbnb revenues from the above charts. Cardify told TechCrunch that after peaking at around +70% in the March-April timeframe, “average booking sizes have now normalized and are approximately 30% higher on a YTD basis.”

There is weakness in October, the charts show, but that appears to be at least partially seasonal given the 2019 line, so I don’t want to over-ascribe rising COVID cases as the cause. The drooping line, however, was echoed in similar SimilarWeb data that was also shared with The Exchange. The dataset concerned accommodation booking volume around the world for a number of travel services, including Airbnb. Its data tracking the US market showed that a bookings recovery through September that made up some ground on March lows was undercut by October declines. Europe’s bookings’ recovery peaked in July and has been falling ever since. Asian volume is creeping higher, but down sharply from prior levels.

It was a mixed picture, but as Airbnb is doing better than its broader industry per Cardify, the aggregated data could be leading us to be more pessimistic than we otherwise need to be. We’ll see shortly what the real numbers are, but I couldn’t help but share what I was reading with you. On to the S-1!

Before DoorDash filed, we were going to talk about Brex today in this space after Airbnb. But, since we got extra busy, expect those notes early next week on The Exchange.

Market Notes

The week was super busy with earnings, so I’ve collected a few notes from calls with select companies after they reported. Apologies to everyone’s’ favorite reporting firm, but we’re space-limited.

Appian crushed earnings expectations. What drove the low-code application development services’ growth forward? According to CEO Matt Calkins, it wasn’t a single thing. Instead, the company’s performance was driven by a long ramp he said, though he did also state that the concept of low-code has reached the public consciousness in new, higher levels during the last few quarters.

Why? The year’s chaos pushed companies into new patterns faster than they had anticipated. Chalk this result up to the accelerating digital transformation being real, which is good news for startups. (For more on Appian and the low-code space, head here.)

Alteryx gave The Exchange an earnings first, providing both its newly former CEO Dean Stoecker and its new CEO Mark Anderson to chat results. The company crushed Q3 expectations, but its Q4 projections did not excite investors. What was up? Anderson argued that ARR growth, not forward GAAP revenue projections, is the most transparent and clear view of an expanding software company, to paraphrase his thinking. You can’t ignore revenue, he said, but given the nuances in how revenue is counted, pay attention to ARR.

Alteryx has a solid ARR target for 2021. We’ll see how investors view its Q4 results and if they align their thinking to that of the new CEO. Alteryx’s former CEO is bullish, saying that in time the market will realize that analytics is at the epicenter of digital transformation. And his company will be there with code to sell.

Moving along, earlier this week I asked a number of VCs about the software venture capital market in the wake of Monday’s sharp selloff and my question about what might happen to public and private software companies if other stocks suddenly became more attractive — strong vaccine news on Monday was later overwhelmed by surging cases as the week went along, but on Monday Zoom lost billions in value as investors fled.

One set of responses came in late, but I wanted to share them all the same as they were more bullish than I anticipated. In the view of Laela Sturdy, a general partner at Alphabet Capital G, “private software investors are unlikely to change their investing patterns much as a result of fluctuations in the public market,” adding later that “public market changes would have to be very extreme — as in 30 percent or more — in order to impact growth stage valuations.”

The connection between public valuations and trading patterns and private capital deployment exists, but how closely the two are linked depends on what’s happening at any given moment, and it appears that at the moment private investor excitement about software is durable.

Sturdy explained why that may be: “Long-term secular trends around cloud adoption, automation and AI, data, security, fintech infrastructure, and the ongoing rapid acceleration of digital transformation will help tech companies maintain their status as the darlings of growth investors in both the private and public markets.”

- Hopin raised $125 million at a $2.125 billion valuation after scaling to $20 million in ARR in under a year. Wow.

- Square and PayPal earnings augur well for fintech startups overall, though it appears that most fintech money is going to only the latest-stages of that niche. (TrueBill just raised $17 million, notably.)

- Udemy wants $100 million more.

- What’s ahead for edtech startups now that edtech stocks are taking hits?

- Menlo Security landed $100 million more at an $800 million valuation. Not bad!

Various and Sundry

And finally, the rest of the stuff that I couldn’t get to this week. Here we go:

- Chatted with Cambridge Innovation Capital, a neat venture capital firm from Cambridge in the U.K. — not the Cambridge on the American East Coast. More to say here, but the good news is that hubs of innovation really are maturing into startup factories the world around.

- I got my hands on an early copy of a survey of LPs put together by Allocate. It comes out Monday I think, but it said that “only 20% of [LP] respondents said COVID had slowed their investment activities,” which helps explain all the funds we’ve seen in the past few months.

Closing with something fun, remember that look we did of the performance of various startups in Q3? That was fun. Anyhoo, no-code “online form builder” JotForm told The Exchange that its revenue is up 50% from its 2019 results, that its enterprise customer base is up 620%, and that it expects to reach “100,000 total paid users by end of year.” Neat!

from TechCrunch https://ift.tt/3eZRZai

via IFTTT

Post a Comment