Software is eating the world, and that grub can be costly. As the market for enterprise tools and software continues to balloon, organizations are spending more and more on that software across an increasingly complicated and rapidly evolving landscape.

That’s where Clearfind comes in.

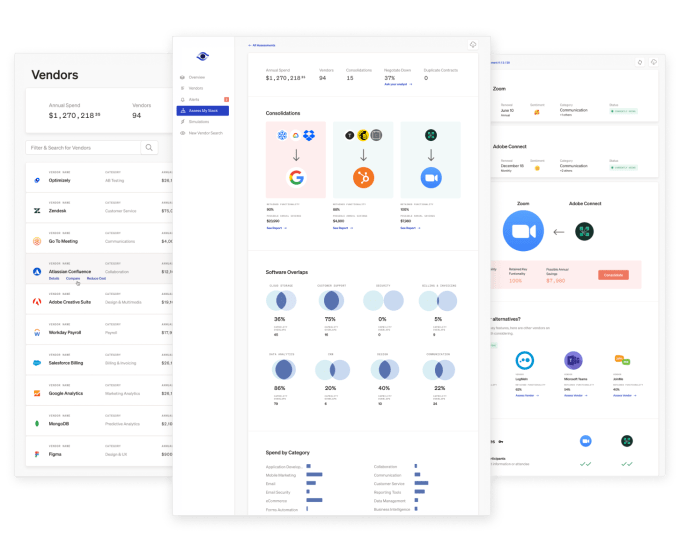

Clearfind was founded (and bootstrapped) by James Layfield and Jocelyn Simon. The startup aims to provide clarity and transparency to organizations looking to buy enterprise software. Over the past two years, Clearfind has been building out its backend, which is a mix of machine learning and humans, to distill a software offering down to its features.

When clients join the Clearfind platform, they give the startup access to their backend through integrations with products like Sage, Quickbooks, SAP, etc. so that Clearfind can take a look at their overall software spend. CIOs or CTOs can then see if there are any redundancies in their current software suite. These executives can also input the use case their looking to solve and Clearfind will deliver a detailed report on which SaaS products have the features to solve for it.

Before Clearfind, this process could be incredibly manual or costs tens and sometimes hundreds of thousands of dollars through a consultancy. And even then, those consultants may likely be recommending the products that have paid for top placement, not necessarily the best fit.

Image Credits: Clearfind

Clearfind makes money by charging 1.2 cents per dollar of annual software spend. The company says that it usually reduces spend by about 30 percent for most of the companies it works with by helping them optimize their software ecosystem and eliminate redundancies.

Clearfind also generates revenue through referral fees that come from search within Clearfind. Layfield and Simon were clear that vendors can not pay to influence search results or for placement on the Clearfind front-end, but rather pay for the leads that come through. These fees vary from vendor to vendor.

“When a vendor gets a lead from us, they prioritize it because it’s the most qualified lead they’ll ever get,” said Layfield. “That vendor will know everything. about the buyer and that the buyer is looking for all the criteria their product meets, and how much the buyer is willing to pay. That’s a level of qualified lead that just does not exist.”

Layfield explained there is an even more important reason for vendors to pay a referral fee, which is the implied LTV of a Clearfind lead. A customer that actually wants and needs the product, and the features it provides, is far less likely to churn.

Clearfind isn’t alone in the space. YC-backed Vendr, which is already profitable, is also looking to reduce SaaS spend and Intello, which doesn’t just give a view of software in use but also includes a compliance component.

from TechCrunch https://ift.tt/3khkeSV

via IFTTT

Post a Comment