The venture capital market appears to be getting later, larger and more expensive. As a result, fintech — one of its hottest and most-funded sectors — is evolving in a similar manner.

For late-stage fintech companies, it’s great news. But for smaller players, is the shift towards bigger, more mature rounds undercutting their ability to attract capital and reach scale?

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Venture capital getting later and larger was something we saw repeatedly in our examinations of what happened in Q3 2020 more broadly. For example, during our look into United States’ results during the period, we noted that “54% of all venture capital money invested in the United States in the third quarter was part of rounds that were $100 million or more,” with those 88 rounds — a record — totaling $19.8 billion.

The other 1,373 rounds in the quarter had to split the rest of the money. And the percentage of rounds that are late-stage is rising, along with their average deal size, to add to the trend.

Fintech appears to be in a very similar boat.

The Exchange previously dug into the fintech VC market, focusing our examination on the payments, insurtech, wealth management and banking verticals.

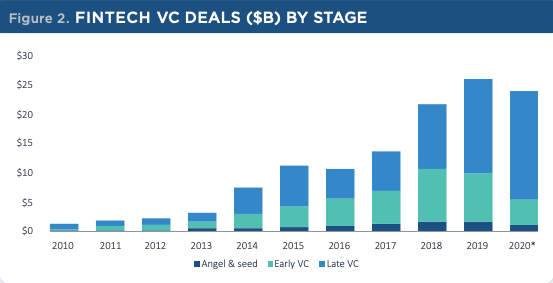

This morning, leaning on a report from PitchBook covering fintech’s third quarter, I want to highlight how the vertical is also tilting later-stage — a trend to keep in mind as we care not only about which startups are gearing up to go public, but also which ones have a shot at raising the capital they need to make it to the growth stage.

This morning, leaning on a report from PitchBook covering fintech’s third quarter, I want to highlight how the vertical is also tilting later-stage — a trend to keep in mind as we care not only about which startups are gearing up to go public, but also which ones have a shot at raising the capital they need to make it to the growth stage.

More big, and more late

Top-line numbers from PitchBook concerning North American and European venture capital results for fintech in Q3 are as follows: $8.9 billion in total capital raised, +$1.3 billion or +17% from Q2 2020’s $7.6 billion haul.

But, as PitchBook notes, “only 414 deals closed during the quarter—the lowest count since Q3 2017.” More capital then, into fewer rounds. That sounds familiar.

Initially, when looking at the dataset, we were going to note that consumer fintech startups are having a great year, while it appears that certain B2B fintech categories were pulling back. Indeed, after raising $3.7 billion in 2019, consumer-facing fintechs in North America and Europe have already raised $5.9 billion in 2020.

But that growth story was dwarfed by the figures on this chart:

Via PitchBook, shared with permission.

from TechCrunch https://ift.tt/2H4gJlu

via IFTTT

Post a Comment